Malliavin Greeks under Black-Scholes Dynamics#

This notebook is part of the materials that I used for my industry expert Lecture at KCL. Slides and further details will be available at a later date.

In this notebook, we are going to illustrate the estimation of Greek sensitivities using Malliavin Calculus.

import numpy as np

from aleatory.processes import GBM, BrownianMotion

import numpy as np

from scipy.stats import norm

%config InlineBackend.figure_format ='retina'

import matplotlib.pyplot as plt

my_style = "https://raw.githubusercontent.com/quantgirluk/matplotlib-stylesheets/main/quant-pastel-light.mplstyle"

plt.style.use(my_style)

plt.rcParams["figure.figsize"] = (10, 7)

plt.rcParams["figure.dpi"] = 100

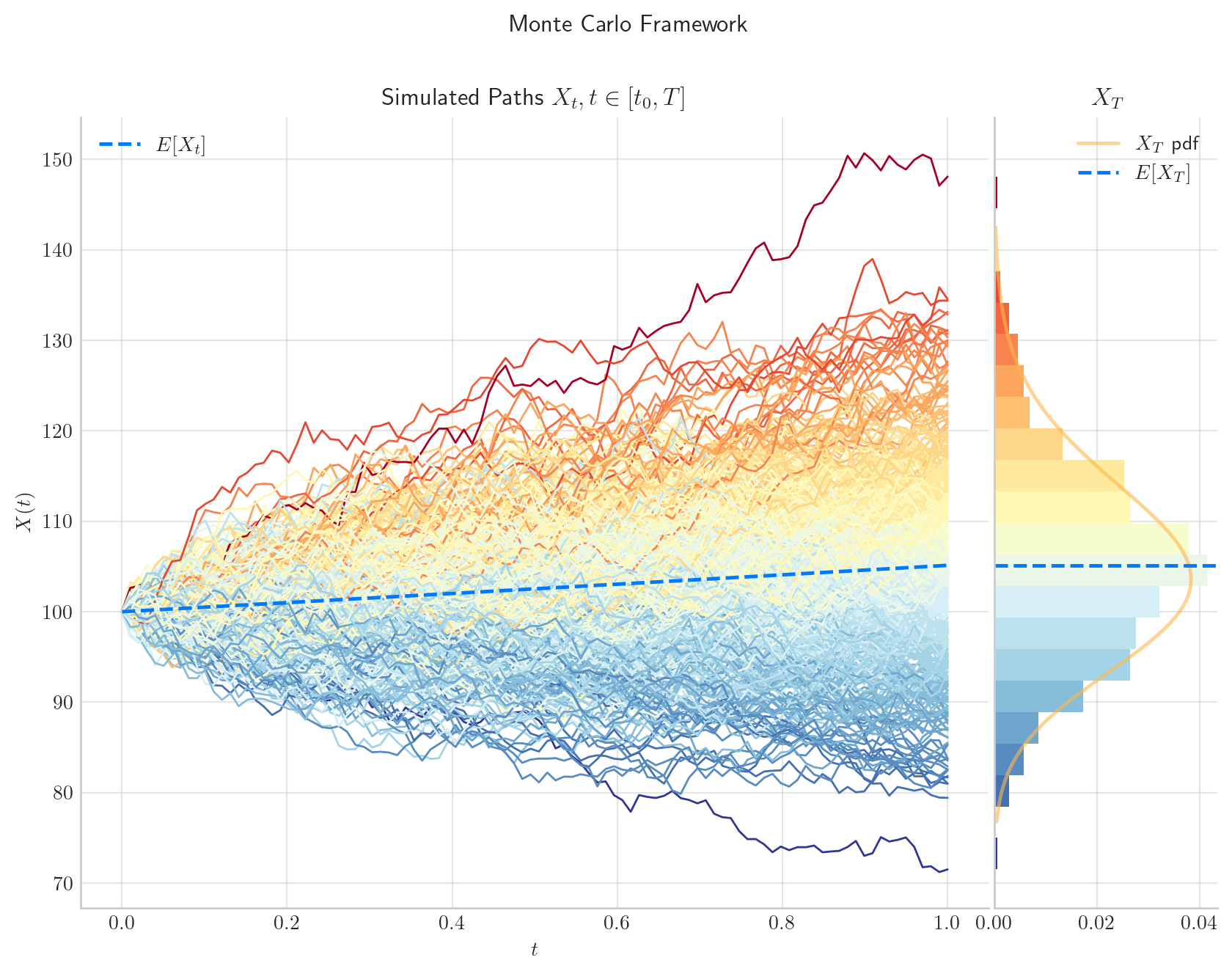

Process Dynamics#

We are going to use a Geometric Brownian process, i.e. Black-Scholes world, to model the dynamics of the price of the underlying asset. This means that \(X\) satisfies the following SDE

\[dX_t = r X_t dt + \sigma X_tdW_t,\]

with \(X_0=x_0>0\), where \(W_t\) denotes a standard Brownian Motion, and both \(r\) and \(\sigma\) are known parameters.

r = 5%

\(\sigma\) = 10%

\(x_0=100\)

Maturity T=1

x0 = 100.0

r = 0.05

sigma = 0.1

T = 1.0

Malliavin Weight#

(2)#\[\begin{equation}

w = \dfrac{2 \int_0^T \dfrac{X_s}{\sigma} dW_s}{x \int_0^T X_t dt} + \dfrac{1}{x}

\end{equation}\]

Note

The weights only depend on the Dynamics and not on the payoff function!

Payoff : European Option#

K=101 # Strike is going to be fixed in this notebook

def payoff(x, kind="call"):

if kind == "call":

return np.maximum(x-K, 0)

elif kidn == "put":

return np.maximum(K - x, 0)

else:

return 0

Analytical Delta#

d_plus = (np.log(x0/K)+(r + 0.5*sigma**2)*T)*(1.0/(sigma*np.sqrt(T)))

d_minus = d_plus - sigma*np.sqrt(T)

std_normal = norm(loc=0, scale=np.sqrt(1))

delta = std_normal.cdf(d_plus)

delta

0.6738238303604167

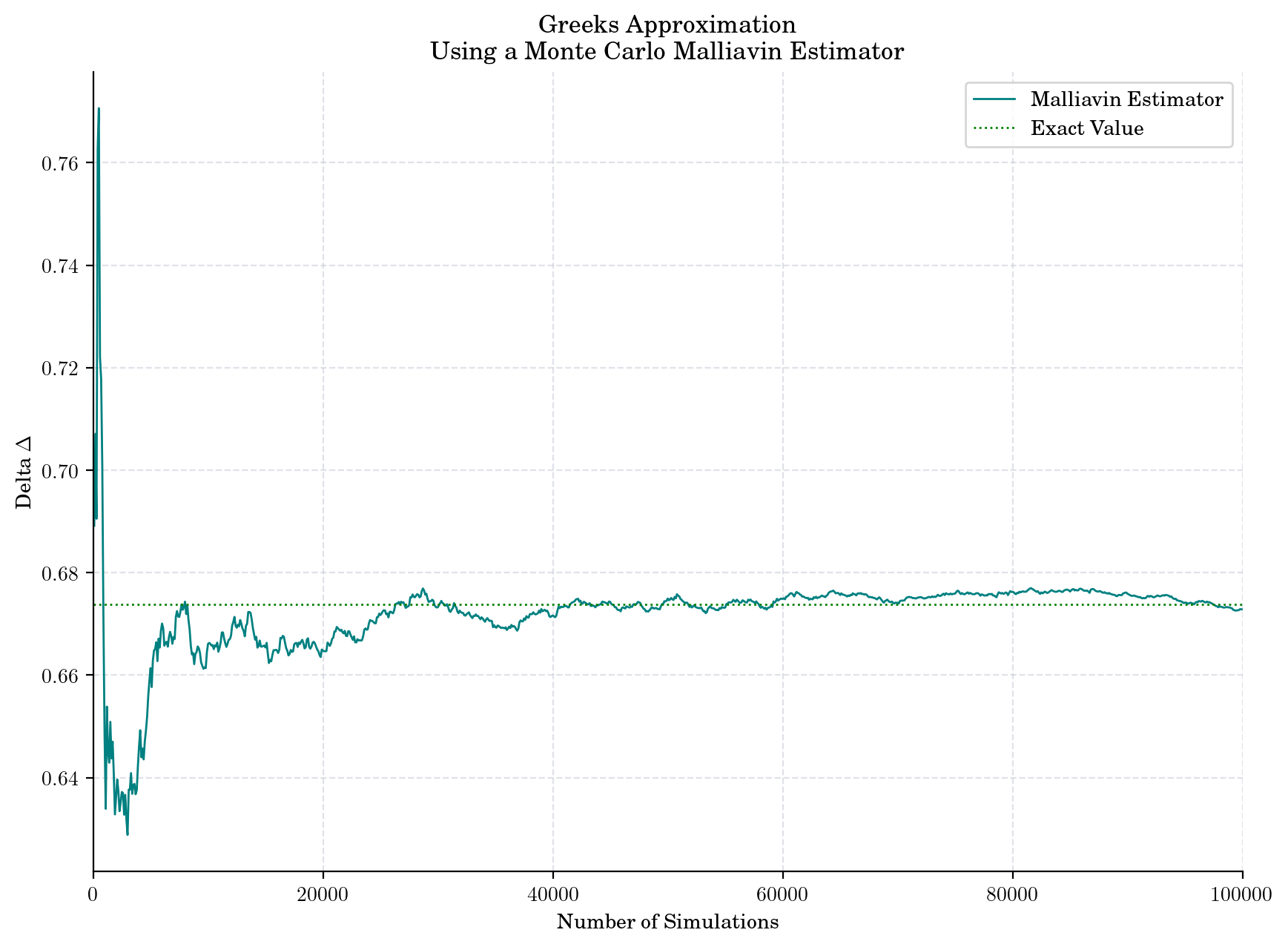

Numerical Estimates#

def estimate_delta_malliavin(payoff, r, sigma, x0, T, N):

browniam_marginal = norm(loc=0, scale=np.sqrt(T))

brownian_sample = browniam_marginal.rvs(N)

gbm_sample = x0*np.exp((r - 0.5*sigma**2)*T + sigma*brownian_sample)

constant = np.exp(-1.0*r*T)/(sigma*x0*T)

deltas = []

sizes = range(100, N+1, 100)

for k in sizes:

mc_estimator = np.mean(payoff(gbm_sample[:k])*brownian_sample[:k])

delta = constant*mc_estimator

deltas.append(delta)

return sizes, deltas

N = 100000

sizes, malliavin_deltas = estimate_delta_malliavin(payoff=payoff, r=r, sigma=sigma, x0=x0, T=T, N=N)

plt.plot(sizes, malliavin_deltas, color="teal", label="Malliavin Estimator")

plt.hlines(delta, 0, sizes[-1], color="green", linestyle=":", label="Exact Value")

plt.xlim([0.0, sizes[-1]])

plt.ylabel("Delta $\Delta$")

plt.xlabel("Number of Simulations")

plt.title("Greeks Approximation\n Using a Monte Carlo Malliavin Estimator")

plt.legend()

plt.show()

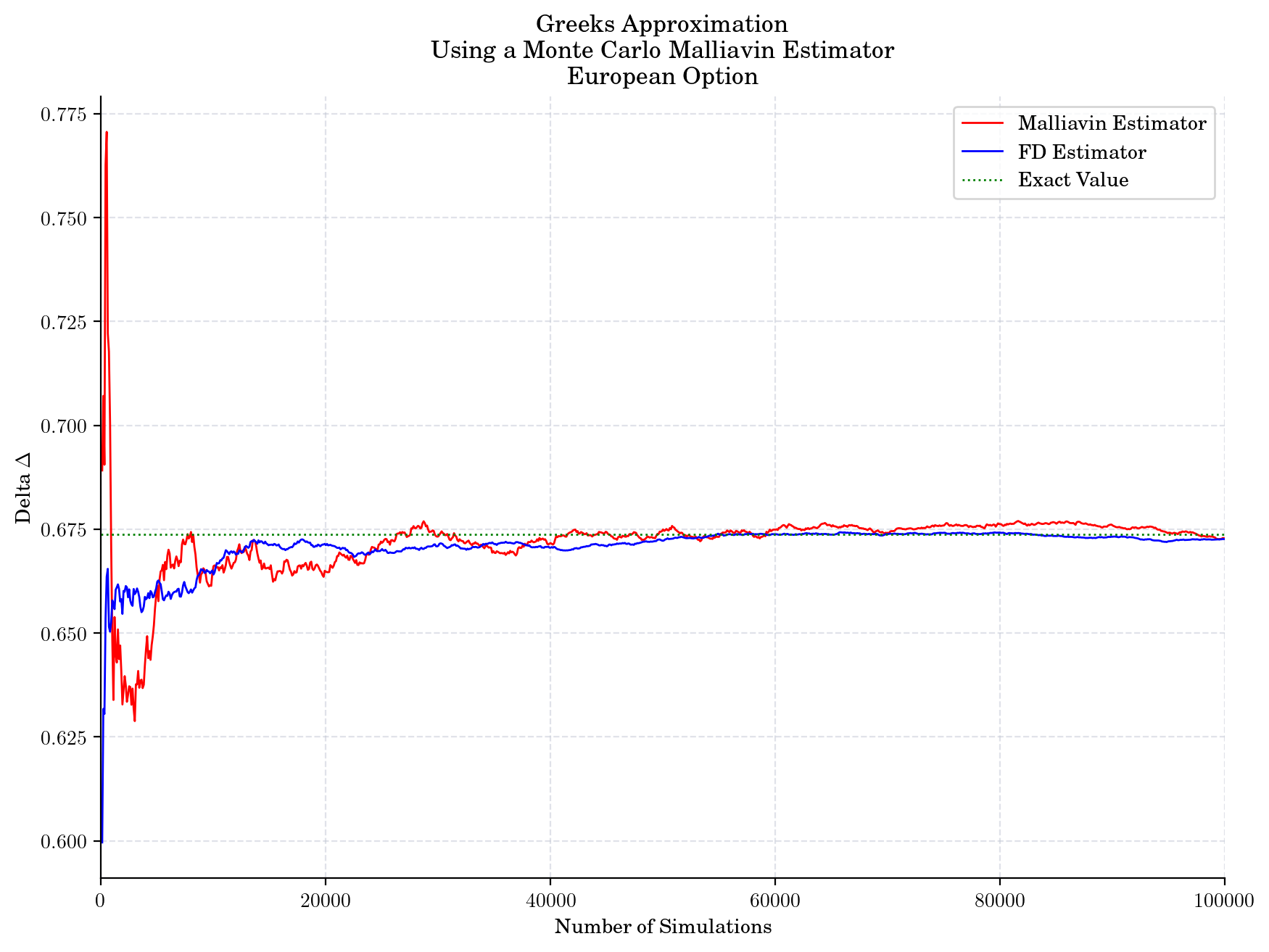

def estimate_delta_fd(payoff, r, sigma, x0, T, N, epsilon=0.001):

browniam_marginal = norm(loc=0, scale=np.sqrt(T))

brownian_sample = browniam_marginal.rvs(N)

gbm_sample_up= (x0 + epsilon)*np.exp((r - 0.5*sigma**2)*T + sigma*brownian_sample)

gbm_sample_down = (x0 - epsilon)*np.exp((r - 0.5*sigma**2)*T + sigma*brownian_sample)

constant = np.exp(-1.0*r*T)

pv_plus = payoff(gbm_sample_up)

pv_minus = payoff(gbm_sample_down)

deltas = []

sizes = range(100, N+1, 100)

for k in sizes:

fd = np.mean((pv_plus[:k] - pv_minus[:k])/(2.0*epsilon))

delta = constant*fd

deltas.append(delta)

return sizes, deltas

sizes, fd_deltas = estimate_delta_fd(payoff=payoff, r=r, sigma=sigma, x0=x0, T=T, N=N)

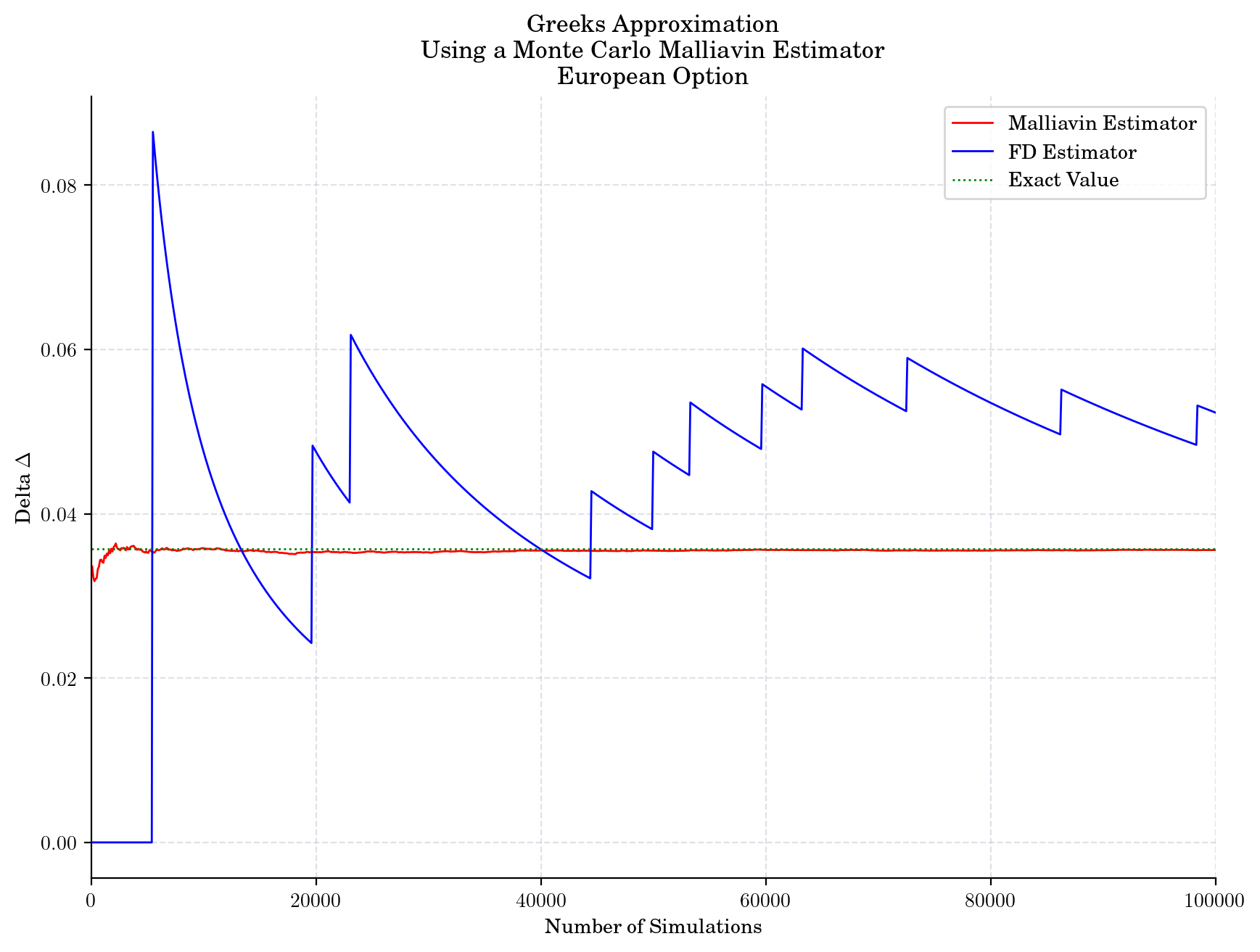

plt.plot(sizes, malliavin_deltas, color="red", label="Malliavin Estimator")

plt.plot(sizes, fd_deltas, color="blue", label="FD Estimator")

plt.hlines(delta, 0, sizes[-1], color="green", linestyle=":", label="Exact Value")

plt.xlim([0.0, sizes[-1]])

plt.ylabel("Delta $\Delta$")

plt.xlabel("Number of Simulations")

plt.title("Greeks Approximation\n Using a Monte Carlo Malliavin Estimator\n European Option")

plt.legend()

plt.show()

Payoff : Digital Option#

def payoff_binary(x, kind="call"):

if kind == "call":

pay = np.maximum(x-K, 0)

return np.array( pay !=0 , dtype=int)

elif kidn == "put":

pay = np.maximum(K - x, 0)

return np.array( pay !=0 , dtype=int)

else:

return 0

sizes, fd_deltas_binary = estimate_delta_fd(payoff_binary, r, sigma, x0, T, N=N)

sizes, malliavin_deltas_binary = estimate_delta_malliavin(payoff_binary, r, sigma, x0, T, N=N)

delta_binary = (np.exp(-r*T)*std_normal.pdf(d_minus))/(sigma*x0*np.sqrt(T) )

delta_binary

0.03568775695099892

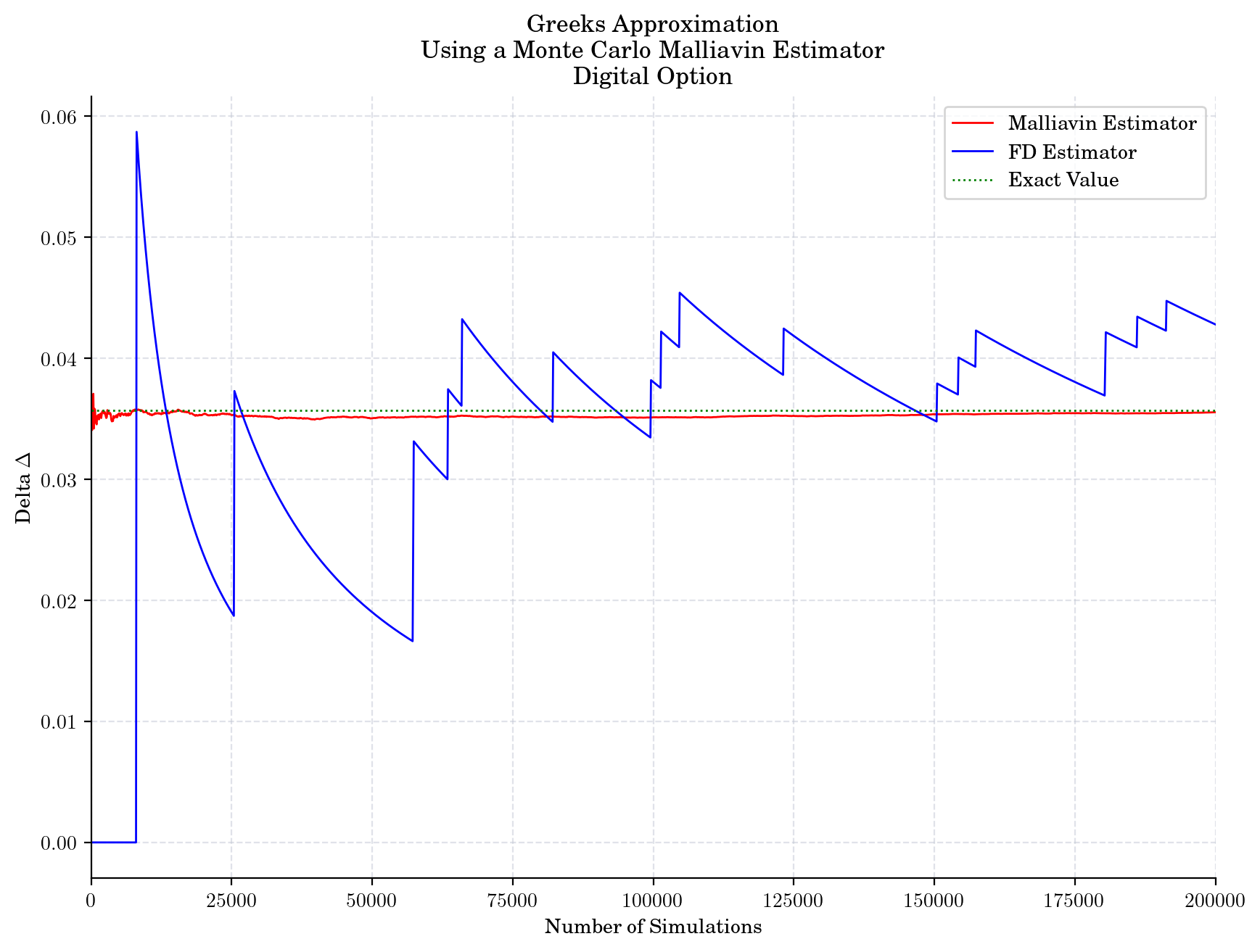

plt.plot(sizes, malliavin_deltas_binary, color="red", label="Malliavin Estimator")

plt.plot(sizes, fd_deltas_binary, color="blue", label="FD Estimator")

plt.hlines(delta_binary, 0, sizes[-1], color="green", linestyle=":", label="Exact Value")

plt.xlim([0.0, sizes[-1]])

# plt.ylim([0.2, 0.7])

plt.ylabel("Delta $\Delta$")

plt.xlabel("Number of Simulations")

plt.title("Greeks Approximation\n Using a Monte Carlo Malliavin Estimator\n European Option")

plt.legend()

plt.show()

sizes, malliavin_deltas_binary = estimate_delta_malliavin(payoff_binary, r, sigma, x0, T, N=2*N)

sizes, fd_deltas_binary = estimate_delta_fd(payoff_binary, r, sigma, x0, T, N=2*N)

plt.plot(sizes, malliavin_deltas_binary, color="red", label="Malliavin Estimator")

plt.plot(sizes, fd_deltas_binary, color="blue", label="FD Estimator")

plt.hlines(delta_binary, 0, sizes[-1], color="green", linestyle=":", label="Exact Value")

plt.xlim([0.0, sizes[-1]])

plt.ylabel("Delta $\Delta$")

plt.xlabel("Number of Simulations")

plt.title("Greeks Approximation\n Using a Monte Carlo Malliavin Estimator\n Digital Option")

plt.legend()

plt.show()

Payoff Asian Option#

def payoff_asian(x, kind="call"):

if kind == "call":

pay = np.mean(x)-K

return np.maximum(pay, 0)

elif kidn == "put":

pay = K - np.mean(x)

return np.maximum(pay, 0)

else:

return 0

def estimate_delta_fd_asian(payoff, r, sigma, x0, T, N, epsilon=0.001):

BM = BrownianMotion(T=T) # Brownian Motion

brownian_sim = np.asarray(BM.simulate(n=100, N=N))

times= BM.times

gbm_sample_up = (x0+epsilon)*np.exp((r - 0.5*sigma**2)*times + sigma*brownian_sim)

gbm_sample_down = (x0-epsilon)*np.exp((r - 0.5*sigma**2)*times + sigma*brownian_sim)

constant = np.exp(-1.0*r*T)

pvps = []

pvms = []

sizes = range(100, N+1, 100)

for i in range(len(gbm_sample_up)):

pv_plus = payoff(x = gbm_sample_up[i])

pvps.append(pv_plus)

pv_minus = payoff(x = gbm_sample_down[i])

pvms.append(pv_minus)

deltas = []

sizes = range(100, N+1, 100)

for k in sizes:

estimator = constant*(np.mean(pvps[:k-1])- np.mean(pvms[:k-1]))/(2.0*epsilon)

deltas.append(estimator)

return sizes, deltas

def estimate_delta_malliavin_asian(payoff, r, sigma, x0, T, N):

BM = BrownianMotion(T=T) # Brownian Motion

brownian_sim = np.asarray(BM.simulate(n=100, N=N))

times= BM.times

mu = r - 0.5*sigma**2

gbm_sim = x0*np.exp(mu*times + sigma*brownian_sim) # N paths

constant = (2.0*np.exp(-1.0*r*T))/(x0*sigma**2)

deltas = []

n = len(gbm_sim[0])

for i in range(len(gbm_sim)):

weight =((gbm_sim[i,n-1] - x0)/np.mean(gbm_sim[i]) ) - mu

delta = constant*payoff(gbm_sim[i])*weight

deltas.append(delta)

estimators =[]

sizes = range(100, N+1, 100)

for k in sizes:

estimators.append(np.mean(deltas[:k-1]))

return sizes, estimators

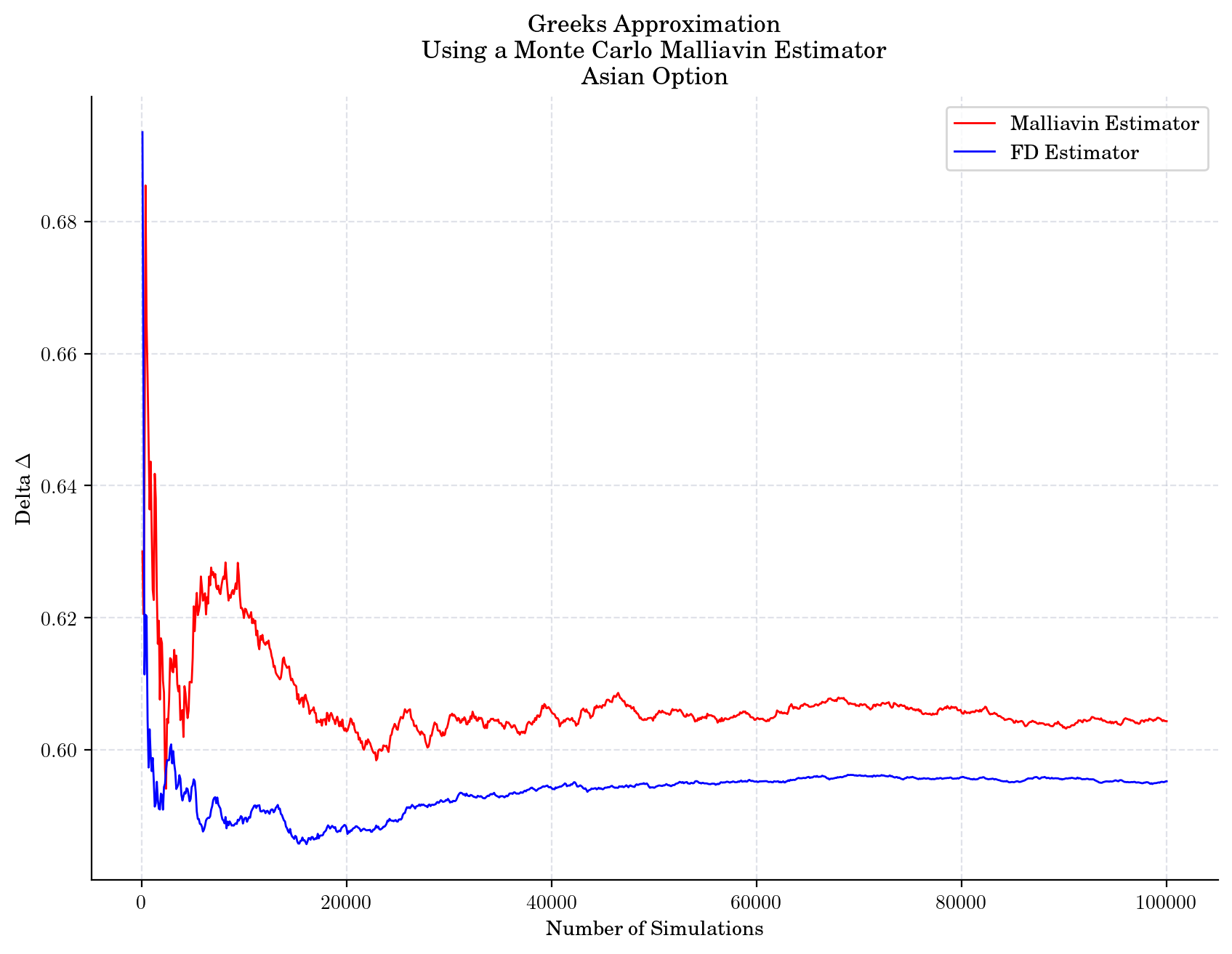

sizes, deltas_fd_asian = estimate_delta_fd_asian(payoff_asian, r=r, sigma=sigma, x0=x0, T=T, N=N)

deltas_fd_asian[-1]

0.59522543564844

sizes, deltas_asian_malliavin = estimate_delta_malliavin_asian(payoff_asian,r, sigma, x0, T, N=N)

deltas_asian_malliavin[-1]

0.6043179718548197

plt.plot(sizes, deltas_asian_malliavin, color="red", label="Malliavin Estimator")

plt.plot(sizes, deltas_fd_asian, color="blue", label="FD Estimator")

plt.ylabel("Delta $\Delta$")

plt.xlabel("Number of Simulations")

plt.title("Greeks Approximation\n Using a Monte Carlo Malliavin Estimator\n Asian Option")

plt.legend()

plt.show()