Day 18: CKLS Process#

The Chan–Karolyi–Longstaff–Sanders (CKLS) process is a stochastic model widely used in financial mathematics to describe the dynamics of interest rates. It generalizes existing models by incorporating a flexible functional form for volatility, allowing better alignment with observed market behaviors. Below, we explore its definition, historical origins, mathematical properties, and applications.

Definition#

The Chan–Karolyi–Longstaff–Sanders (CKLS) model describes a process whose dynamics evolve according to the following Stochastic Differential Equation (SDE)

with initial condition \(X\_0 =x\_0in\mathbb{R}\); where \(W\_t\) is a standard Brownian motion, and the four parameters are constants.

🔔 Random Facts 🔔#

The CKLS model was introduced in a 1992 paper by Louis Chan, G. Andrew Karolyi, Francis Longstaff, and Anthony Sanders in the Journal of Finance. The authors proposed the model to address limitations in traditional interest rate models, particularly their restrictive volatility structures.

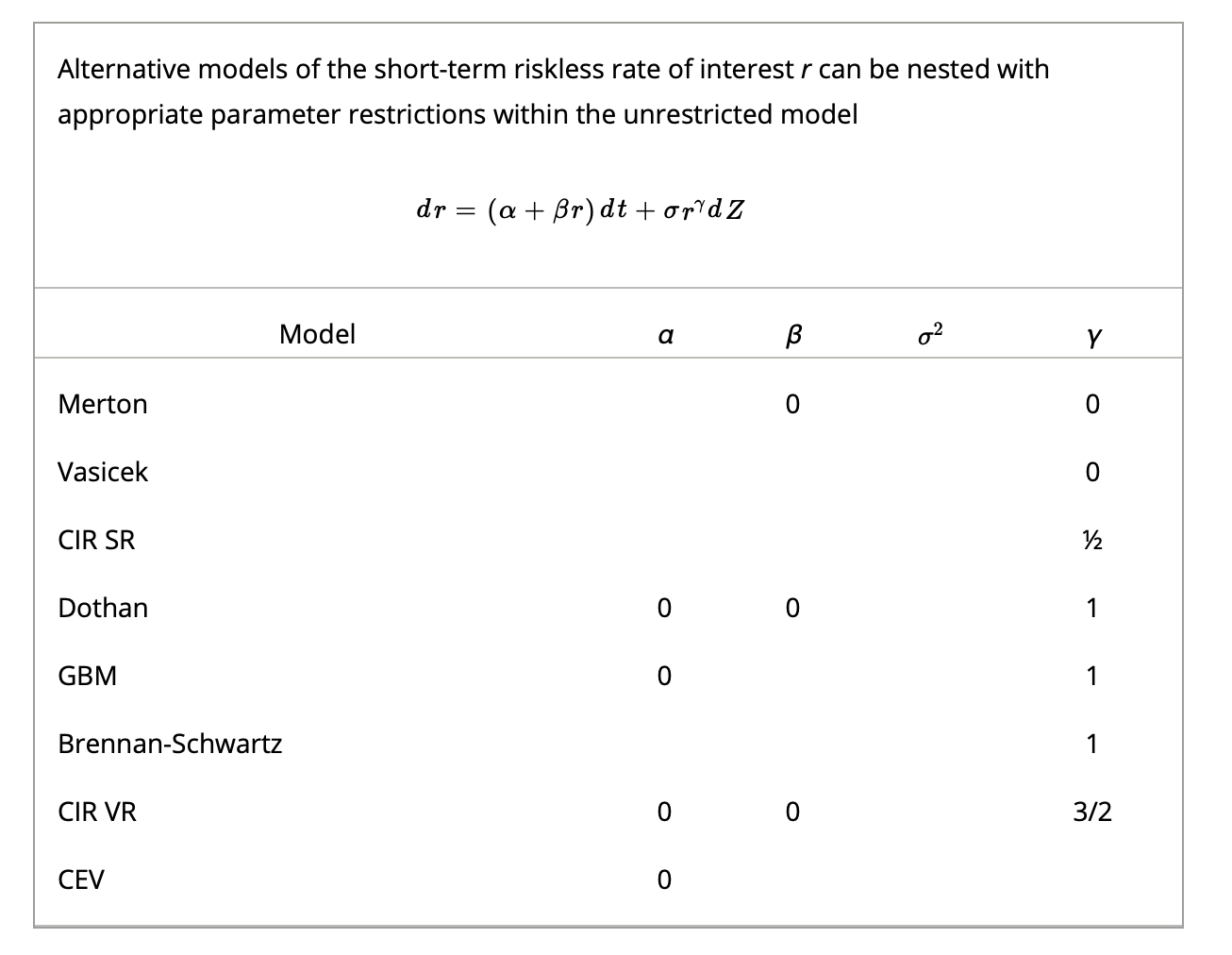

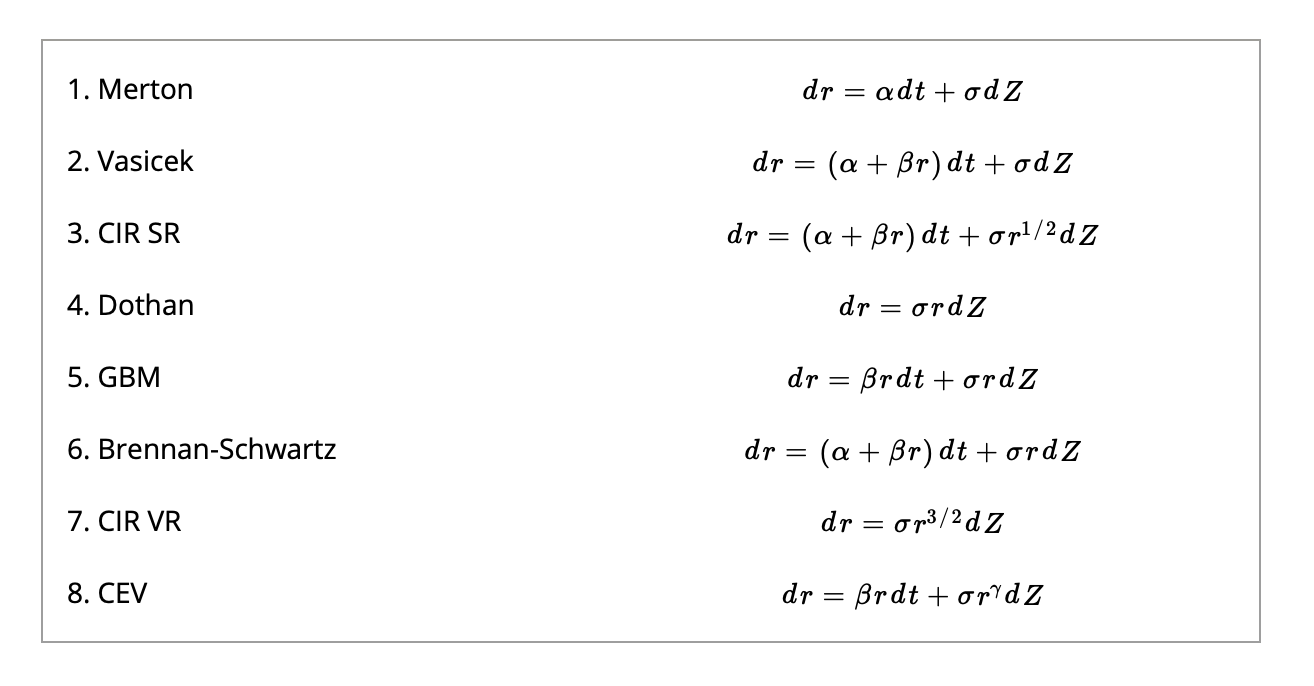

The CKLS stochastic differential equation defines a broad class of interest rate processes which includes many well-known interest rate models. These models can be obtained from the SDE by simply placing the appropriate restrictions on the four parameters

For \(\gamma>0\) the process can be parameterised to ensure it remains non-negative, a desirable property for modelling interest rates.

By encompassing popular models (e.g., Vasicek, CIR), CKLS facilitates model comparison and parameter testing

More to Read 📚#

CHAN, K.C., KAROLYI, G.A., LONGSTAFF, F.A. and SANDERS, A.B. (1992), An Empirical Comparison of Alternative Models of the Short-Term Interest Rate. The Journal of Finance, 47: 1209-1227. https://doi.org/10.1111/j.1540-6261.1992.tb04011.x

P.s. If you are curious about probability distributions visit the Advent Calendar 2023 ✨