Note

Go to the end to download the full example code.

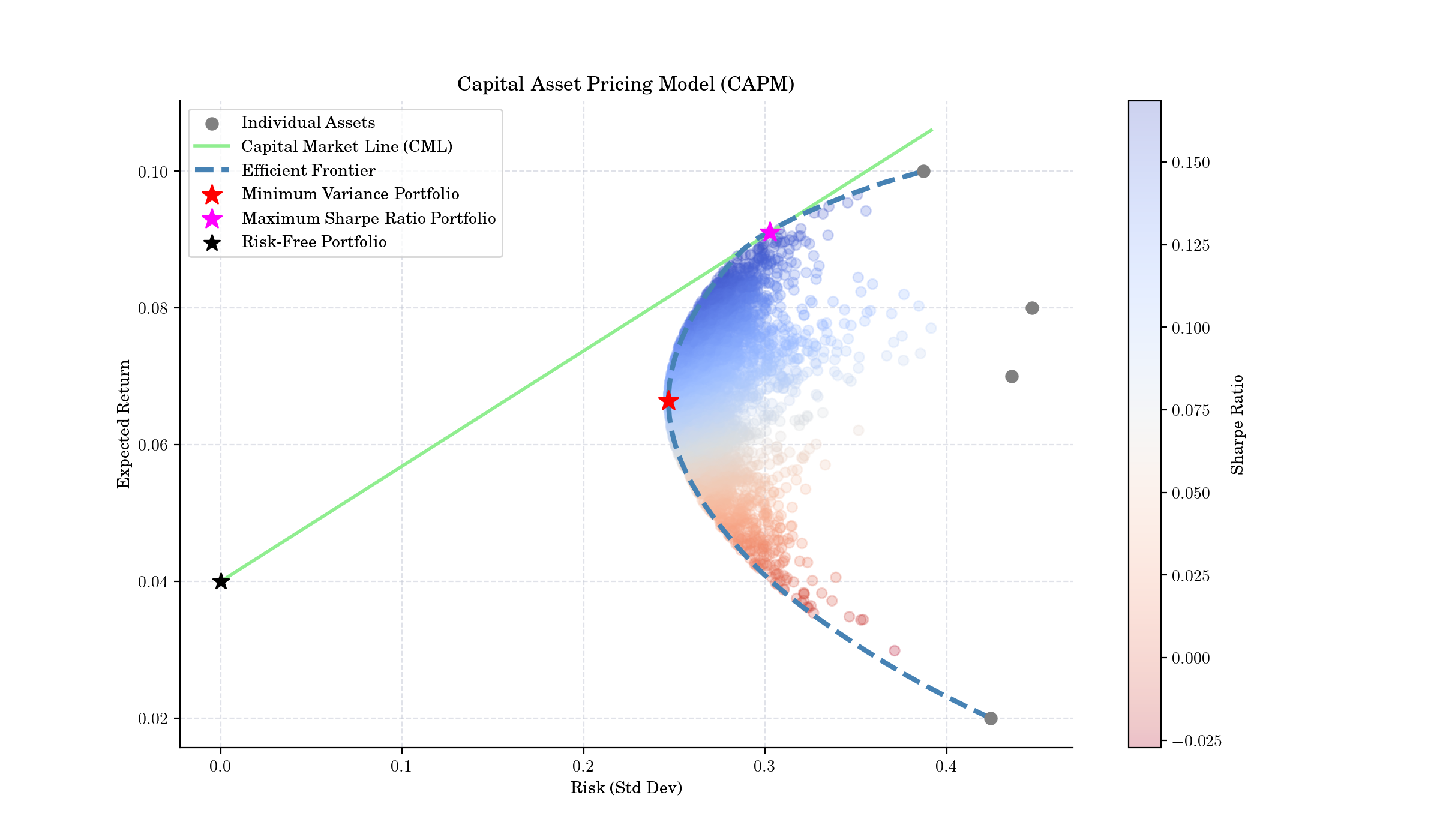

Capital Asset Pricing Model#

# Author: Dialid Santiago <d.santiago@outlook.com>

# License: MIT

# Description: Advent Calendar 2025 - Plot Capital Asset Pricing Model (CAPM)

import numpy as np

import matplotlib.pyplot as plt

from scipy.optimize import minimize

plt.style.use(

"https://raw.githubusercontent.com/quantgirluk/matplotlib-stylesheets/main/quant-pastel-light.mplstyle")

# Asset inputs

mu = np.array([0.18, 0.020, 0.1, 0.07]) # expected returns

variances = np.array([0.20, 0.18, 0.15, 0.19]) # variances

sdtdevs = np.sqrt(variances)

n = len(mu)

Sigma = np.array([

[variances[0], 0.02, 0.04, 0.01],

[0.02, variances[1], 0.02, 0.01],

[0.04, 0.02, variances[2], 0.03],

[0.01, 0.01, 0.03, variances[3]]

])

# Porftfolio simulation

n_portfolios = 5000

returns = np.zeros(n_portfolios)

risks = np.zeros(n_portfolios)

for i in range(n_portfolios):

w = np.random.rand(n)

w /= w.sum()

returns[i] = w @ mu

risks[i] = np.sqrt(w @ Sigma @ w)

# Sharpe ratios

r_f = 0.04 # risk-free rate

sharpes = (returns - r_f) / risks

# Tangency portfolio (maximum Sharpe ratio)

idx = np.argmax(sharpes)

tan_return = returns[idx]

tan_risk = risks[idx]

# Capital Market Line

sml_x = np.linspace(0, risks.max(), 100)

sml_y = r_f + (tan_return - r_f) / tan_risk * sml_x

# Constraints

cons_sum = {'type': 'eq', 'fun': lambda w: np.sum(w) - 1}

bounds = [(0, 1)] * n

# Portfolio functions

def port_return(w):

return w @ mu

def port_risk(w):

return np.sqrt(w @ Sigma @ w)

# Minimum variance portfolio

res_mvp = minimize(port_risk, x0=np.ones(n)/n,

bounds=bounds, constraints=cons_sum)

w_mvp = res_mvp.x

# Efficient frontier

target_returns = np.linspace(mu.min(), mu.max(), 50)

frontier_risk = []

for r in target_returns:

cons = (

cons_sum,

{'type': 'eq', 'fun': lambda w, r=r: w @ mu - r}

)

res = minimize(port_risk, x0=np.ones(n)/n,

bounds=bounds, constraints=cons)

frontier_risk.append(res.fun)

# Plot

fig, ax = plt.subplots(figsize=(12, 7), dpi=200)

plt.scatter(risks, returns, c=sharpes, cmap="coolwarm_r", alpha=0.25)

plt.colorbar(label="Sharpe Ratio")

plt.scatter(sdtdevs, mu, marker='o', s=50, color='black', edgecolor='black', zorder=5, label="Individual Assets")

plt.plot(sml_x, sml_y, linestyle='-', linewidth=2, label="Capital Market Line (CML)", color="lightgreen")

plt.plot(frontier_risk, target_returns, linewidth=2, linestyle='--', color="steelblue", label="Efficient Frontier")

plt.scatter(port_risk(w_mvp), port_return(w_mvp), s=200, marker='*', color='red', zorder=5, label="Minimum Variance Portfolio")

plt.scatter(tan_risk, tan_return, s=200, marker='*', color='magenta', zorder=5, label="Maximum Sharpe Ratio Portfolio")

plt.scatter(0, r_f, s=200, marker='*', color='black', zorder=5, label="Risk-Free Portfolio")

plt.xlabel("Risk (Std Dev)")

plt.ylabel("Expected Return")

plt.title("Capital Asset Pricing Model (CAPM)")

plt.legend()

plt.show()

Total running time of the script: (0 minutes 3.882 seconds)