Note

Go to the end to download the full example code.

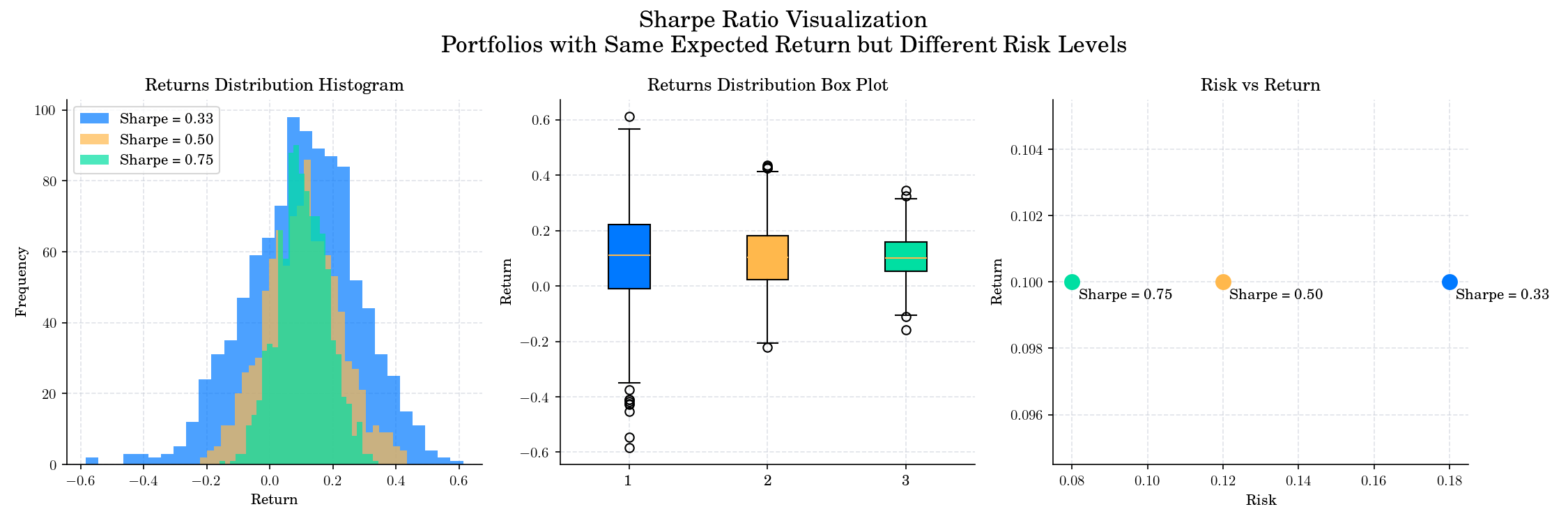

Sharpe Ratio#

# Author: Dialid Santiago <d.santiago@outlook.com>

# License: MIT

# Description: Advent Calendar 2025 Day 12 - Sharpe Ratio Visualization

import numpy as np

import matplotlib.pyplot as plt

quant_pastel = "https://raw.githubusercontent.com/quantgirluk/matplotlib-stylesheets/main/quant-pastel-light.mplstyle"

plt.style.use(quant_pastel)

r_f = 0.04 # Risk-free rate

# Portfolios with same expected return but different risk

returns = np.array([0.10, 0.10, 0.10])

risks = np.array([0.18, 0.12, 0.08])

sharpes = (returns - r_f) / risks

fig, axes = plt.subplots(1, 3, figsize=(15, 5), dpi=150)

samples = []

for (r, risk, sharpe) in zip(returns, risks, sharpes):

sample = np.random.normal(loc=r, scale=risk, size=1000)

samples.append(sample)

axes[0].hist(sample, bins=30, alpha=0.7, label=f"Sharpe = {sharpe:.2f}")

axes[2].scatter(risk, r, s=100)

axes[2].annotate(f"Sharpe = {sharpe:.2f}",

(risk, r), xytext=(5, -12),

textcoords="offset points")

axes[0].legend()

bplot=axes[1].boxplot(samples, vert=True, patch_artist=True)

colors = ['#0079ff', '#ffb84c', '#00dfa2',]

for patch, color in zip(bplot['boxes'], colors):

patch.set_facecolor(color)

axes[0].set_title("Returns Distribution Histogram")

axes[0].set_xlabel("Return")

axes[0].set_ylabel("Frequency")

axes[1].set_title("Returns Distribution Box Plot")

axes[1].set_ylabel("Return")

axes[2].set_title("Risk vs Return")

axes[2].set_xlabel("Risk")

axes[2].set_ylabel("Return")

plt.suptitle("Sharpe Ratio Visualization\n Portfolios with Same Expected Return but Different Risk Levels", fontsize=16)

plt.tight_layout()

plt.show()

Total running time of the script: (0 minutes 3.387 seconds)