Day 20: Orstein-Uhlenbeck Process#

The Ornstein-Uhlenbeck (OU) process is a stochastic process that plays a critical role in fields like physics, finance, and biology. It is a type of Gaussian process known for its mean-reverting properties, making it particularly useful for modelling phenomena that oscillate around a long-term average.

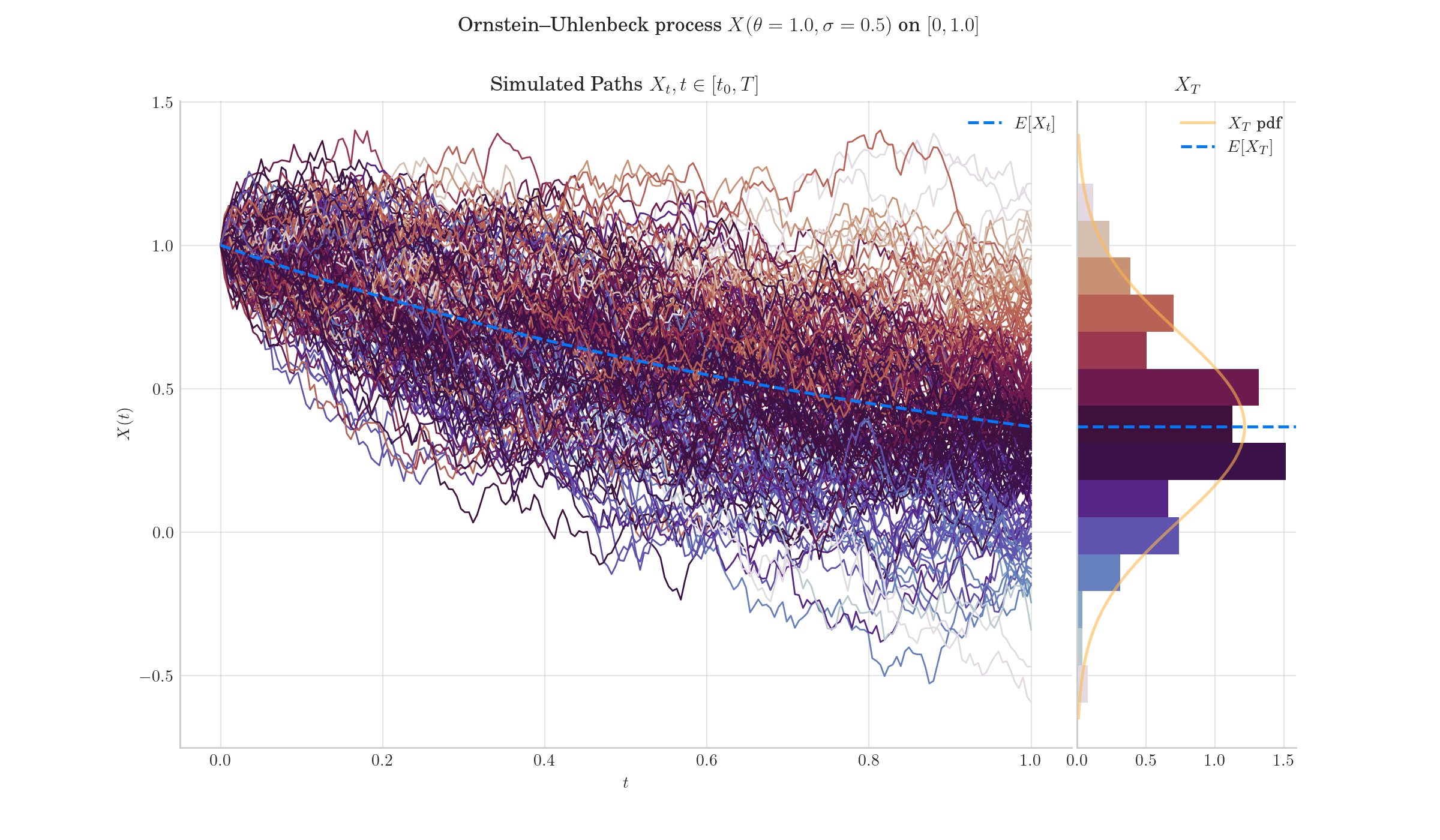

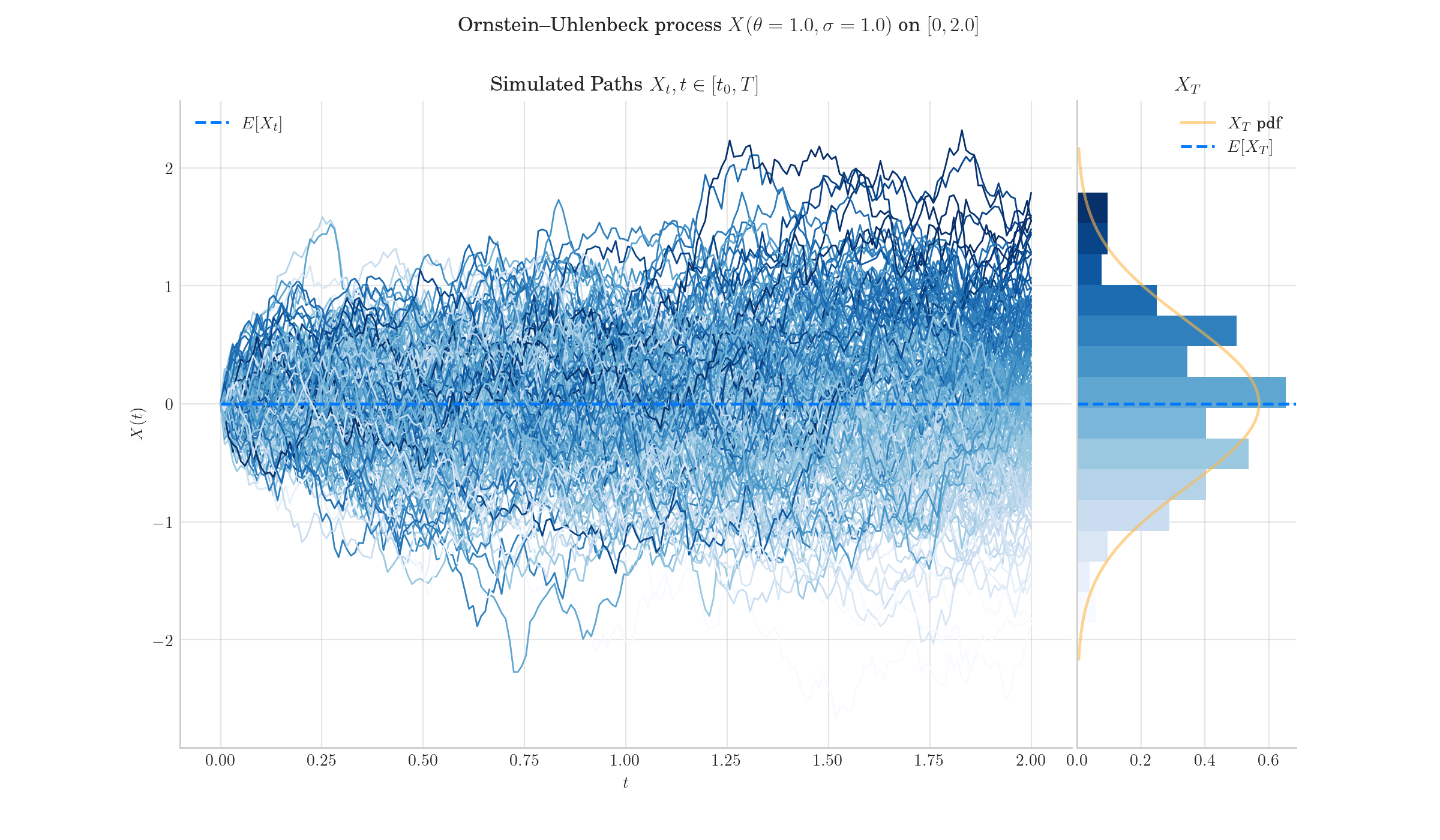

Simulation of an Orstein-Uhlenbeck Process. Image made with aleatory#

Definition#

The OU process is defined by the following stochastic differential equation (SDE):

where:

\(X_t\) is the value of the process at time :math:`t

\(\theta > 0\) is the rate of mean reversion

\(\mu\) is the long-term mean level

\(\sigma > 0\) is the volatility parameter

\(W_t\) is a standard Wiener process (Brownian motion)

Random Facts#

The process was introduced by physicists Leonard Ornstein and George Eugene Uhlenbeck in 1930 to describe the velocity of a massive particle undergoing Brownian motion in a viscous fluid.

The Ornstein–Uhlenbeck process can also be considered as the continuous-time analogue of the discrete-time AR(1) process.

The Ornstein–Uhlenbeck process is a stationary Gauss–Markov process, which means that it is a Gaussian process, a Markov process, and is temporally homogeneous. In fact, it is the only nontrivial process that satisfies these three conditions, up to allowing linear transformations of the space and time variables.